Private clients:Tailored portfolio solutions

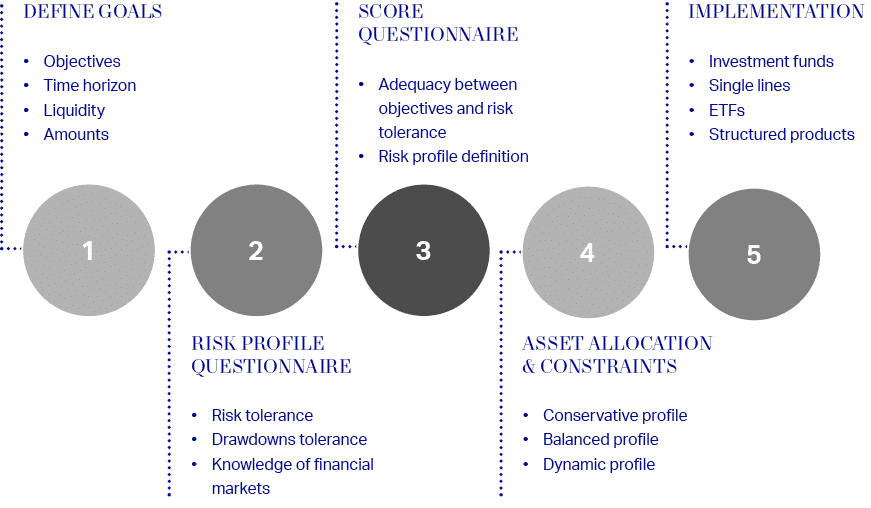

Before creating or restructuring your investment portfolio, 1875 FINANCE is committed to understand your needs and performs a detailed analysis of your financial situation.

Multiple tools

Portfolios are designed using a particularly rigorous process involving investment cycles considerations, macro-economic analysis, risk budgeting and optimisation processes.

To limit risks associated to human cognitive bias, we use quantitative proprietary and external tools.

| Asset allocation model | Longview Economics |

|

| Risk management | SunGrad APT |

|

| Optimisation of risk/return | Silex |

|

| Bond analyses | Bloomberg |

|

| Fund analyses | Morningstar |

|

| CRM / PMS | Mydesq |

|

For more information

Should you require any additional information, do not hesitate to contact our team of specialists.

Contact

Any questions?

We would be happy to provide you with more detailed information about 1875 FINANCE.

More links

Our new independent model.

Discover the approach and values that set 1875 FINANCE apart.